So I have rarely ventured into parking my funds or pay subscriptions for trading advice.

However, this was one that I have monitored and followed for several years now, and have committed a monthly subscription to his trade advice and recommendations.

You can find more information about Nimbus Capital here.

This guy is super legit. His name appears as Zaw Oo on Facebook when I first followed him years ago. He was giving out trading education and recommendations for free and it took me years to notice that he was legit, fit and proper as a trading guru. Then he started out Nimbus Capital and the rest is history.

Thankfully he hasn't reached euphoric popularity either, but his following is gaining a lot of momentum.

And the key reason is because he is real and he is honest about everything he preaches. He doesn't spiel about doubling, tripling your money with "ho kang tao" and "insider news" bullshit.

For him, the basic methodology of risk management and technical analysis is all he preaches, with no guarantees that each trade will be a P or an L. Coverage is SG, US, HK stocks.

He will provide his calculated Entry Level, Stop Loss and Take Profit levels ONLY when there are worthwhile trades popping up on his scanner.

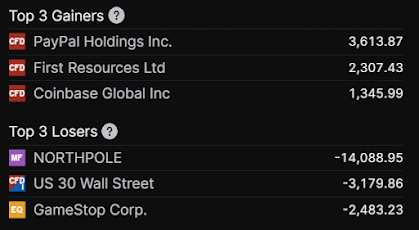

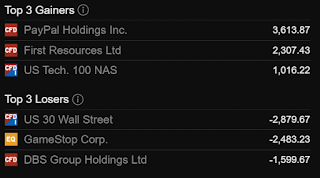

There are certainly hits and misses. So no trade of his is a guaranteed win, but even if your stop loss is hit, you will already know what you would lose, as long as you kept to his approach and instructions!

So for his USD $20 per month package, I am getting good enough updates on this daily scanners (stocks which fulfill his criteria), his recommended trade set ups, and other educational stuff (which I hardly bother with).

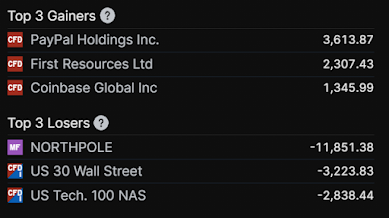

The money for me is in the recommended trade set ups. They are sound, and they are good, with a good Win/Loss, Risk/Reward ratio.

More enthusiastic followers can even sign up for his training courses (he charges $3,000) and learn his criteria for stocks appearing on his scanners, and also learn to structure their own trade set ups. Maybe when I leave my day job, I might want to go for his course.

Very highly recommended.