So the past six weeks have been quite surreal in the markets.

The Fed has announced QT (Quantitative Tightening) and it starts this month starting at a reduction in Treasury Bill holdings of $50B, rising steadily up until September where it will reduce by $95B monthly. Traders are also betting the Fed is hiking interest rates by at least 250bp this year.

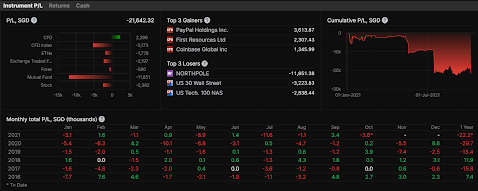

Now back to the past six weeks, the market (especially in the US) has had some time to digest this and clearly it DOES NOT LIKE IT. The market has been tanking since ATH and in the last six weeks have fallen almost 20%!

Last Friday night’s session, the S&P500 index actually touched this 20% mark, which signals an official bear market or recession, but bounced of from there to close still above those technical levels.

Yet the will be more carnage to come as interest rates rise and QT takes funds out of the markets,

QT alone will shrink the market, meaning while in the past, retailers could bank on QE funds to flow in, and cause a meteoric rise in stock markets (and many other correlated asset classes), those in the know will expect the opposite to happen this time around, with a similar opposite scenario playing out.

To make matters worse for the stock markets, as interest rates increase, less market participants can rely on leverage as it gets more and more expensive. Loans become more expensive. Cash becomes more expensive. This will surely further exacerbate the tanking of the stock markets.

What is this going to mean for the retail investor?

IMHO ONLY! DYODD!

Firstly, don’t even think about buying the dip. The pain has only just begun, so no point getting more cash trapped (buy and hold long term liao).

Secondly, consider dollar cost averaging. DCA a small, manageable amount monthly, quarterly, annually. This will help you catch the lows. Yet low can always go lower, maybe even three years of lower lows! So make sure you are comfortable doing this.

Thirdly, watch your loans. As interbank interest rates go up, interest rates on loans will go up. This will impact your loan repayments and thereby your cashflows. Conversely, rates of Fixed Deposits and newly issued Bonds will go up too, so it is a good time to review past commitments and consider some diversification into these asset classes.

Lastly, cash is king. We are heading into a new world order. One where the younger generation may not have seen before. The above global monetary policies PLUS geopolitical uncertainty (Ukraine war, runaway inflation) are bound to continue hurting the markets. Having more cash in hand gives one better peace of mind in times of crisis, and furthermore allows astute investors to deploy cash on the real life changing investment opportunities to come.

Consider this. The last real crash was in 2008’s Global Financial Crisis, and before then was 2000’s Dot-com bubble crash. If you came into the workforce in 2009, you’re a Gen Z and all you’d have ever seen was a bull market. Every time the markets dipped, you just BTFD (buy the dip) and things would go up and you’d make money. 14 years of such optimism. Well as Boomers and Gen X will tell you, you’re in for a rough ride.

Hang on to your hats in 2022. It will be quite a volatile ride.